Project's Completed

Project: DFW Land Valuation Analysis for Development

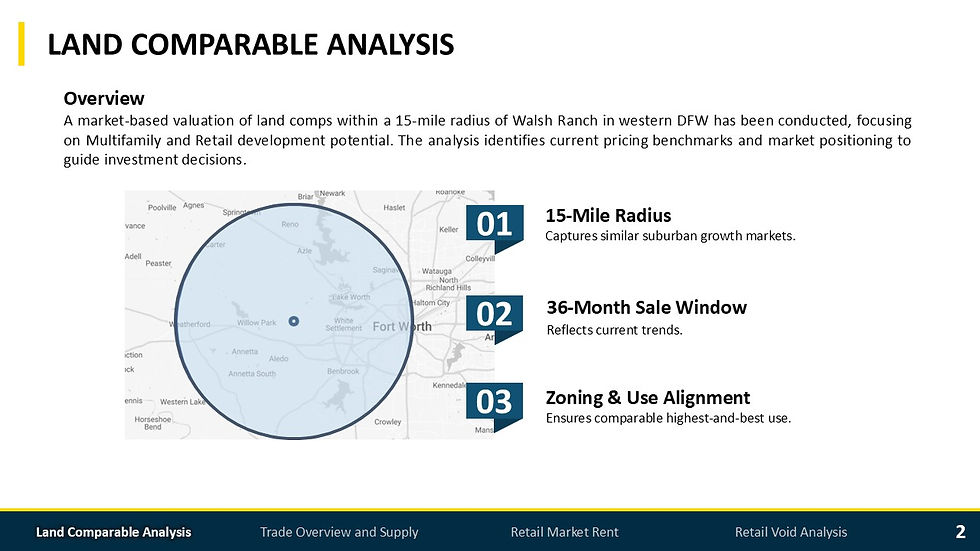

The project conducted a comprehensive market analysis for the Hines Brown Ranch site, encompassing both retail and multifamily land uses . The study included a detailed review of competitive supply and active pipeline projects, land sale comparables from, and an in-depth market rent analysis. I also assessed vacancy and absorption trends, performed retail void analysis focusing on retailers active in comparable DFW locations, and compiled demographic profiles.

Project: Multi-Family Acquisition Model

Redesigned and optimized an existing multifamily acquisition model into a clean, auditable, and modular Excel workbook. The new structure centralized all key inputs into dedicated input sheets, standardized debt and expense logic, and unified outputs under a single Main Analysis sheet. Enhanced model transparency with clear data validation, named ranges, and consistent input formatting. Integrated stress-testing heatmaps, loan amortization summaries, and traceable IRR calculations for accurate investment analysis and scalability.

Project: GP Fund Raising Pitch Deck

Developed a professional investor presentation for a real estate fund specializing in rescue capital investments. The deck highlights the fund’s structure, investment thesis, and competitive edge through clear data visualization, institutional design, and strategic storytelling. The project involved creating a cohesive narrative backed by market research, showcasing expertise in multifamily and distressed real estate opportunities, and aligning presentation style with investor-grade standards.